when will capital gains tax increase be effective

President Joe Biden and many progressive Democrats have proposed taxing capital gains as ordinary income at a top rate of 396 to the extent adjusted gross income. 2021 capital gains tax calculator.

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

President Joe Biden is expected to.

. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. 2022 capital gains tax rates. Its time to increase taxes on capital gains Posted on January 7 2021 by Michael Smart Michael Smart To address wealth inequality and to improve functioning of our tax.

If the top federal capital gains rate rises to 434 percent this would raise the combined tax rate on long-term capital gains to 484 percent. This resulted in a 60. If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can.

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. Dems eye pre-emptive capital gains effective date. The effective date for this increase would be September 13 2021.

This would mean actions taken now. Just like income tax youll pay a tiered tax rate on your capital gains. It appears that the White House is planning to make.

Equally concerning to the more affluent taxpayers is the possibility that tax increases will be retroactive to the beginning of 2021. Currently the capital gains rate is 20 for single taxpayers with income over 441451 and for taxpayers who are married. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. 2022 federal capital gains tax rates. Note that short-term capital gains taxes are even higher.

Its time to increase taxes on. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate increase.

The proposal would increase the maximum stated capital gain rate from 20 to 25. For example a single person with a total short-term capital gain of. It also includes income thresholds for Bidens top rate proposal and.

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Capital Gains Tax In The United States Wikipedia

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

How One Can Face An Infinite Effective Tax Rate On Capital Gains Tax Foundation

Obama S Tax Rates On Investment Would Exceed Clinton S Rates Tax Foundation

Managing Tax Rate Uncertainty Russell Investments

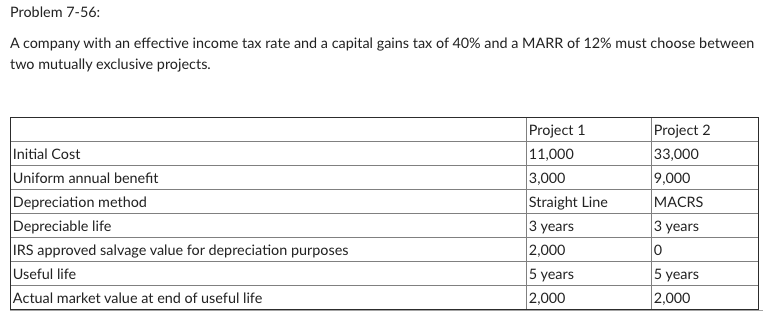

Solved A Company With An Effective Income Tax Rate And A Chegg Com

Solved 1 After Tax Pw Of Both Options 2 Which Option Is Chegg Com

How Are Capital Gains Taxed Tax Policy Center

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

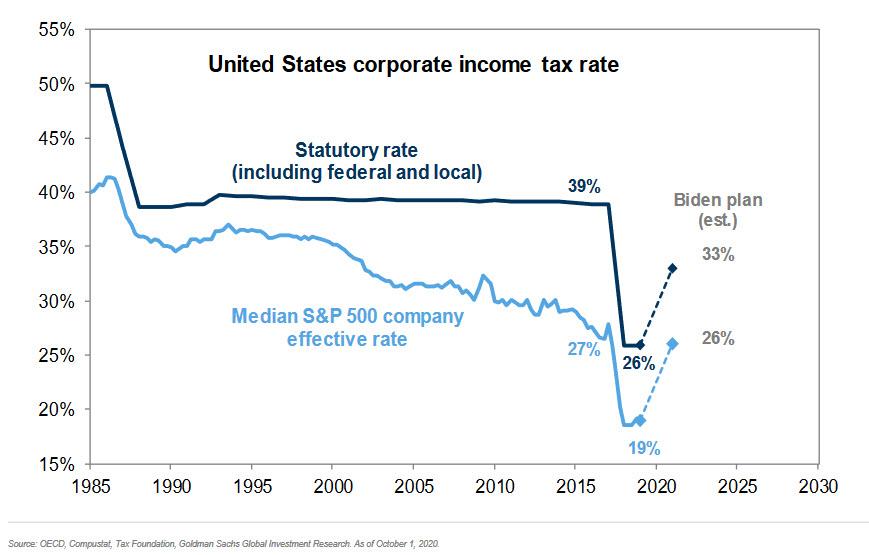

What Is The Difference Between The Statutory And Effective Tax Rate

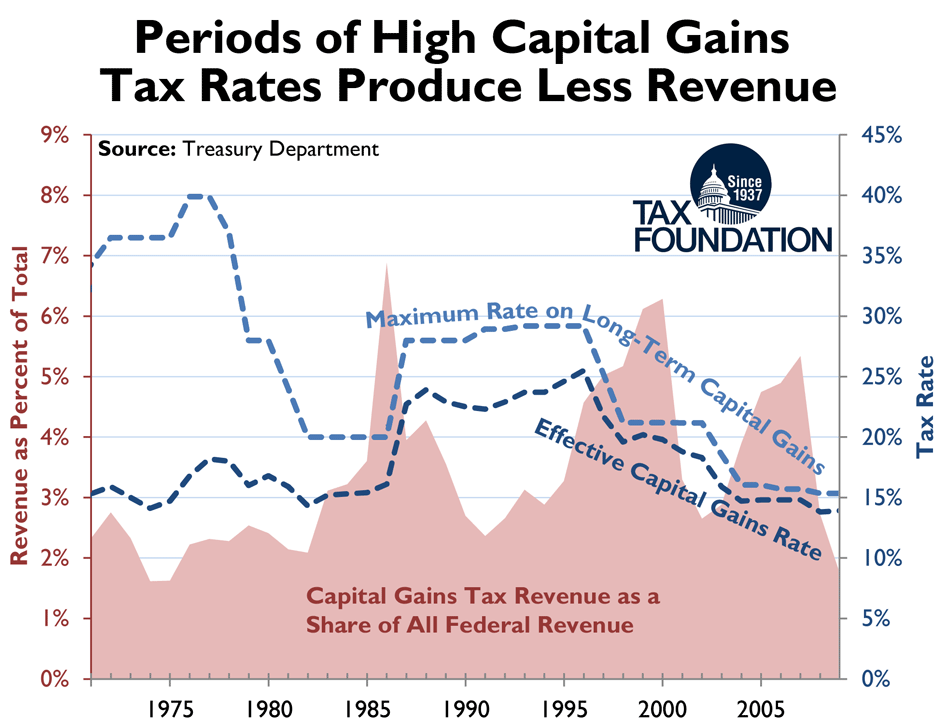

An Overview Of Capital Gains Taxes Tax Foundation

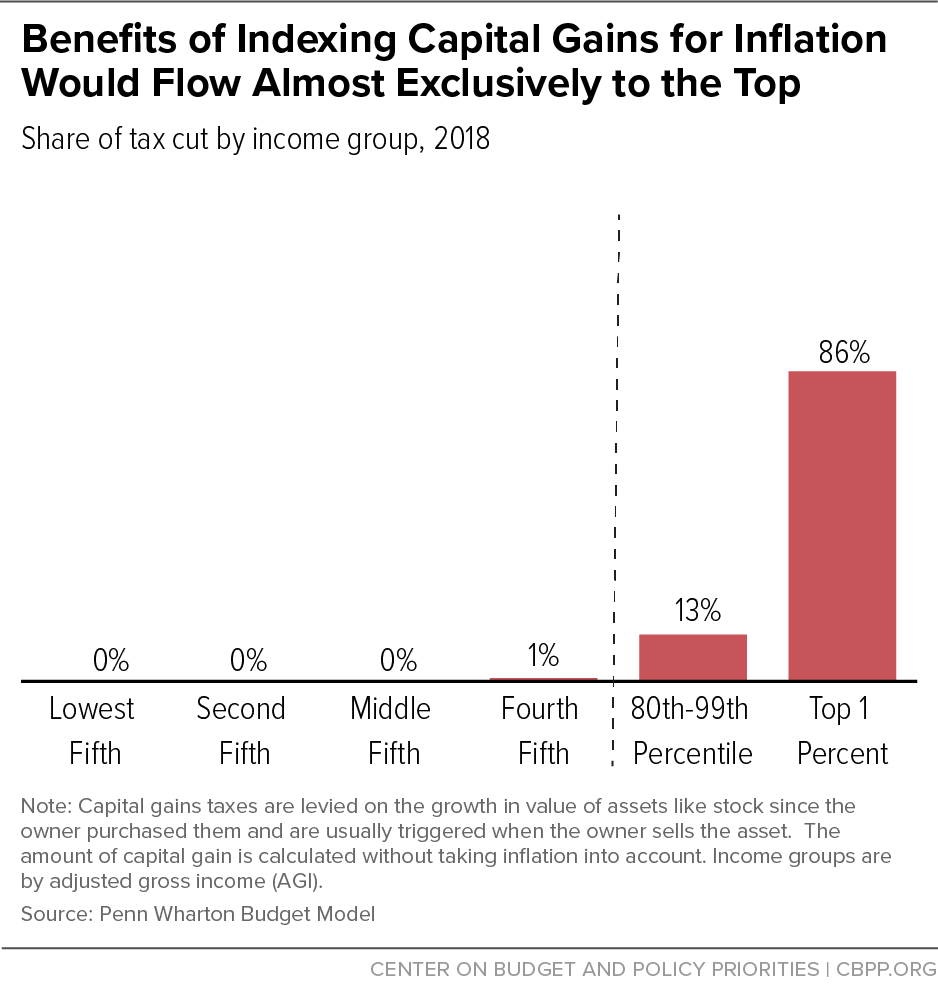

Indexing Capital Gains For Inflation Would Worsen Fiscal Challenges Give Another Tax Cut To The Top Center On Budget And Policy Priorities

Capital Gains Tax In The United States Wikipedia

Tax Rate For Richest 400 Taxpayers Plummeted In Recent Decades Even As Their Pre Tax Incomes Skyrocketed Center On Budget And Policy Priorities

Effective Income Tax Rates Have Fallen For The Top One Percent Since World War Ii Tax Policy Center

What Is The Difference Between The Statutory And Effective Tax Rate

Tyler Durden Blog Biden Will Hike The Top Capital Gains Tax Rate To 39 6 What That Means For Markets Talkmarkets